#Taxes

Politics | Blue State/City Life

The Day Democracy Died in California › American Greatness

On June 20, the California Supreme Court ruled that the Taxpayer Protection Act, a ballot initiative that would have given voters veto power over new taxes…

Politics | Politics

Rand Paul's 'Festivus Report' exposes $900B in government squander

Sen. Rand Paul, R-Ky., released his ninth edition 'Festivus' report showcasing $900 billion in federal waste.

Politics | Politics

Biden's daughter owes thousands in income taxes, lien documents show

President Biden's daughter has thousands in unpaid taxes, according to tax lien filed in December

News | News

PODCAST | Warning Against The Fed’s Quest For A Central Bank Digital Currency

Listen now (46 min) | If you regularly read or listen – hopefully you do both – you know I am no fan of the Federal Reserve. From its genesis on Jekyll Island to its mishandling of crisis after crisis to its unholy relationship with the World Bankers

News | News

PODCAST | How The Government Makes It Harder To ‘Keep On Truckin'

Listen now | We need to understand that everything we consume – everything that we buy when we go to the store, regardless of whether it's food, whether it's a product of another nature – it's brought to us by a truck. Trucks are essen

News | News

PODCAST | We Need To Do Better With The Gifts They Gave Us

LISTEN NOW | Before we get into this morning’s segment of The Captain's America: Third Watch with Matt Bruce, guest hosted by Kyle Warren, I wanted to say a few words about Memorial Day: what it means and how the woke segment of our society is affe

News | News

PODCAST | Raising The Debt Ceiling Is Still Deficit Spending

LISTEN NOW | We shouldn't be happy with the McCarthy bill that went through the House because it still raises the debt ceiling and it still spends beyond our means. We are nowhere close to spending within our means regarding the revenue stream that g

Business & Finance | Business & Finance

Remote Employees: Employee Dream, Employer Nightmare | Workplace Coach Blog

Remote employees: an employee dream that becomes an employer's nightmare, the real tax and liability issues and what you need to navigate

News | News

Understanding That The Federal Reserve Isn’t A Government Entity

If you listen to the Underground USA podcast you have heard me talk about the book, The Creature from Jekyll Island: A Second Look at the Federal Reserve. It is an accurate and damning account of the genesis, structure, and mission of the US Federal Reser

News | News

PODCAST | Do Aliens Race-Bait?

Listen now (26 min) | Before we get to this morning’s segment on The Captain's America: Third Watch with Matt Bruce, I want to comment on the lead story over at UndergroundUSA.com today. It has to do with fascism and regulation. It’s titled, Fasc

News | News

Fascism Facilitated By Regulation

The system was supposed to be pretty simple, so much so that even a moderately educated person could understand it. The Legislative Branch was supposed to craft and pass laws – codified by either the president’s signature or a veto override, the Execu

News | News

PODCAST | Trump’s Unnecessary Flirtation With Disaster

Listen now (29 min) | Before we get into this morning's segment on The Captain's America: Third Watch with Matt Bruce, I'd like to comment on Donald Trump's statement attacking Ron DeSantis. Matt and I talked about this in the segment

News | News

Americans Spent More on Taxes in 2021 Than on Food, Clothing and Health Care Combined

In a Fascist State you pay government more money in tribute, taxes. In the United States that is now the case. “According to newly released data from the Bureau of Labor Statistics, Americans in 2021 once again spent more on average on taxes than

Politics | Politics

VP Harris Breaks Tie, Senate Passes Democrats’ ‘Inflation Reduction Act’ Climate, Tax, and Spending Bill

Democrats in the Senate voted along party lines on Sunday to pass the so-called “Inflation Reduction Act.”

Politics | Joe Biden/Biden Administration

Biden Adviser: Reconciliation Bill Doesn’t Raise Tax Rates, It Just Requires Paying ‘Minimal Fair Share’ to Generate Revenue

On Thursday's broadcast of CNN's "The Lead," Senior Adviser to President Joe Biden Gene Sperling claimed that the reconciliation deal announced by Senate | Clips

News | News

PODCAST | Maybe DHS Should Consider Putting a Fence Around Disney

As DHS Secretary Mayorkas humiliates himself before Congress in continuing to push the false narrative of the snowflake "domestic terrorism" threat, perhaps the Left could better serve itself by putting a fence around Disney Woke-World given that Florida&

News | News

Biden's Proposed Billionaire Tax Spotlights the Unconstitutionality of Our Current Tax System

The Biden administration continues to prove, with each passing day, that they have little regard for the US Constitution when it comes to governing the nation. President Biden’s proposed “billionaire minimum income tax” not only thumbs its nose at t

Politics | Politics

Wednesday Cartoon: California Democrats Are Pouring Gasoline on Taxpayers and Lighting Us on Fire

Democrat lawmakers want to burn taxpayers to the ground.

News | News

SUNDAY DIGEST: White House Executes Egregious Spin on Straight-Forward Statement by Biden; Putin 'Cannot Remain in Power'

White House Executes Egregious Spin on Straight-Forward Statement by Biden; Putin 'Cannot Remain in Power' President Biden said Russian President Vladimir Putin "cannot remain in power," as he declared the Russian invasion of Ukraine a "strategi

- Afghanistan

- Biden

- Bitcoin

- BLM

- Canada

- Capitalism

- CapitolRiots

- China

- COVID

- Cryptocurrency

- CryptoMining

- DeSantis

- Economics

- Education

- EthicsWaivers

- EU

- Farmers

- Fascism

- FBI

- FDA

- FJB

- Freedom

- Government

- GreatReset

- HeartDeisease

- Houthi

- Iran

- News

- Podcast

- PodcastsOnAmazonMusic

- PoliticalPrisoners

- Politics

- Putin

- SaudiArabia

- SupplyChain

- Taliban

- Taxes

- Trudeau

- Truth

- UAE

- Ukraine

- UndergroundUSA

News | News

Federal Reserve's Powell, Global Financiers Demonstrate Ignorance & Fear on Cryptocurrencies

Demonstrating either a significant fear through a lack of knowledge on the subject or an understanding that has produced well-warranted fear, Federal Reserve Chair Jerome Powell said cryptocurrencies, including stablecoins, present risks to the US financi

News | News

The Fascist Scheme of Federally Centralized Government

The word has been so misused over time that its meaning has been turned on its head. Fascism is not a product of right-wing ideology. It is – and there is no disputing this if you are being honest – a political philosophy more intricately aligned with

News | News

SUNDAY DIGEST: According to The Atlantic Nuclear War 'Would Hurt the Climate'

According to The Atlantic Nuclear War 'Would Hurt the Climate' The Atlantic, a far-left magazine owned by Apple founder Steve Jobs's billionaire widow Laurene Powell Jobs, published an article by Robinson Meyer warning that if the Russian i

Music | Music News

Ozzy and Sharon Osbourne quitting Los Angeles for UK to avoid soaring tax rates

Ozzy Osbourne and Sharon Osbourne have lived stateside for many years, but the couple - who celebrate their 40th wedding anniversary this year - are set to return to the UK

News | News

IRS Tax Season Promises Complications, Delays for Taxpayers; A Perfect Opportunity to Advance Radical Tax Reform

If you are one of the millions waiting for your 2020 tax refund, you are right to be frustrated – and even angry – about the fact that you’ll be expected to file your 2021 tax return on time, else find yourself at the mercy of the Internal Revenue S

News | News

US Treasury to Create Unlegislated Regulations on Crypto Wallets, Change 'Definition of Money'

Using the fear-tactic buzzwords “terrorist financing” and “money laundering,” the US Treasury Department, under Treasury Secretary Janet Yellen, is set to expand regulations into the cryptosphere without seeking legislation to do so. A rule contai

Politics | Politics

IRS to start requiring facial recognition scans to access tax returns

The Internal Revenue Service is going to start requiring users of its online tax payment system to provide a selfie to a third-party company in order to access their accounts.

Politics | Politics

IRS will require taxpayers to sign up with ID.me to access their online accounts - CBS News

Starting this summer, an ID.me account will be required to view a tax transcript or pull up payment history on IRS.gov.

Politics | Politics

Report: More Than 600K People Leaving New York And California For Lower-Taxed States

A new report released on Monday revealed more than 600,000 people have left New York and California during the pandemic for lower-taxed states as the two Democrat-led states continue to extend strong COVID-19 restrictions.

Miscellaneous | Interesting Links

Here Are the Tax Changes Coming to Venmo, Cash App, PayPal and Other Apps – Forbes Advisor

Venmo, Cash App, Zelle and other third-party apps to report payments of $600 or more to the IRS. Here’s what this means for you.

Politics | Leftists Are Insane

You Won't Believe Why California Is Considering Raising Taxes

There’s a certain type of architecture from the mid-20th century called “California Crazy.” Think of a donut shop shaped like a big concrete donut or a restaurant shaped like a hat....

Politics | Politics

Don't forget to declare income from stolen goods and illegal activities, IRS says

Don’t forget to report to the IRS any income you brought in from drug deals, bribes, stolen goods, prostitution or other illegal activity.

Politics | Politics

Biden’s latest tax-the-rich scheme would be an unworkable and possibly unconstitutional mess

If it sounds too good to be true, it’s because it is.

News | News

White House Finds It's 'Unfair' For Businesses To Raise Prices If Taxes Go Up

In a stunning display of slow-wittedness, White House press secretary Jen Psaki told reporters Monday that the White House believes it...

News | News

The Podcast | Underground USA | United States

Former President Donald Trump gave hope to the thought that he will be running to retake the White House in 2024. But if he is, in fact, going to run for the presidency again, there are at least two things that simply must happen after Republicans retake

Politics | Interesting Links

In 2020, Americans Paid More In Taxes Than They Spent For Health Care, Food, Entertainment, And Clothing Combined

The average American spent more in taxes last year than on health care, clothing, food, and entertainment expenses combined.

News | News

Democrats Quietly Pass Tax Boon for the Wealthy

Congressional Democrats and Marxists disguised as Democrats have gone silent as they move toward raising the cap on federal tax...

News | News

Marxist Democrats Continue To Spend The US Into Destitution

Senate Democrats have unveiled a draft budget proposal that outlines $3.5 trillion in spending, including for paid medical leave, two...

News | News

The Bi-Partisan Infrastructure Bill Bypasses 'Buy Made in USA'

In a bill that is supposed to benefit the infrastructure of the United States and through that effort US businesses and the American...

News | News

Senators Float Taxing Cryptocurrency Transfers to Fund Bloated Infrastructure Bill

Understanding that the federal government never quests to cull the frivolous spending to fund their projects, the “bi-partisan” group of...

News | News

Biden to Push Green New Deal Through Budget Reconciliation

The Biden administration memo reveals the President’s team has decided to advance the more contentious parts of the hyper-partisan Green...

News | News

NEA 'Disappears' Resolutions from Its Website That Affirm a Pro-CRT Agenda

In a clandestine and wholly non-transparent move, the National Education Association – the nation’s largest teacher’s union – quietly...

News | News

Biden's Global Corporate Tax Hits a Roadblock; 9 Countries Refuse the Idea

The implementation of a global minimum tax to provide cover for the Biden administration's anti-free market taxation plan hit a roadblock...

News | News

IRS Makes Unlegislated Move to Require Cryptocurrency Transfer Reporting

The Treasury Department, in a move not backed by any proposed tax legislation, has called for requiring all transfers above $10,000 worth...

News | News

The Pipe Dreams of the Biden Tax Man

The Biden administration is attempting to create a safety net, after the fact, to protect from a mass exodus of corporate taxpayers due...

News | News

Illegals & The Pandemic: New York Taxpayers Go Deep into Debt by Bending the Knee to Ideology

New York lawmakers are set to explode that’s state’s debt in their striking of a deal to establish a $2.1 billion COVID relief fund for...

News | News

Apparently, We Have Elected the Most Naïve Administration in the History of the World

In a move that calls into question the Biden administration’s gullibility, Treasury Secretary Janet Yellen is set to request a global...

News | News

EPA Purges Science Advisory Boards; Starts Process to Seat Members Agreeable to Agenda

In a rare move, the Biden Environmental Protection Agency dismissed dozens of science advisers in order to align the panels’ ideology to...

News | News

Biden Unveils $2 Trillion Infrastructure Plan That Will ‘Re-Imagine’ a New Climate-Proof Economy

The Biden White House is set to launch its propaganda campaign touting its proposed $2 trillion “infrastructure” plan. Included in...

News | News

Key House Democrat Admits His Party Wants the COVID Expansion of Obamacare Perks Permanent

With the American public distracted by COVID, gender-identity politics, the economy, and social justice totalitarianism, a key House Dem...

News | News

Progressive Blue States Move to Crush Small Business by Taxing PPP Loans

Several Progressive Blue States are considering deviating from a federal policy that made PPP forgivable loans nontaxable, targeting...

News | News

California Schools Using Federal, State, Local COVID Relief Money for Staff Bonuses

If you thought hundreds of billions of American taxpayer dollars to foreign entities in the COVID Relief package was outrageous, how...

News | News

Biden Planning First Major Tax Hike Since 1993

In an act not seen since 1993, President Biden is set to implement the largest hike in federal taxes in almost three decades to fund an...

News | News

$60 Billion in Hidden Tax Hikes in COVID Relief Bill

With the COVID relief bill safely on its way to President Biden’s desk, details are now emerging that reveal a handful of untrumpeted tax...

News | News

Warren Introduces Wealth Tax Targeting 'Millionaires and Billionaires'

A group of US Senators led by Sen. Elizabeth Warren (D-MA), have introduced a bill creating a wealth tax, which would impose a two...

News | News

Biden Administration to Act Unilaterally on Reparations

The Biden administration will begin crafting proposals on reparations – to include the issuance of taxpayer dollars – without the input...

Politics | Demos

California's Bullet Train Over-Budget; Cost Now Over $100,000,000,000

California's massive high-speed rail project is more than a decade behind schedule and an example of grotesque overspending and mismanagement. Experts now say the project is a complete misreading of what the public needs. The so-called Los Angeles-to-San

History | History

8 of History's Strangest Taxes

History is full of kings and governments who have tried to earn money by taxing anything from beards to bachelors.

News | News

Podcast | Underground USA | United States

An irreverent, brutally truthful, fact-based podcast. Not to get biblical sounding, but it is done. We now have a President Biden and a cast of radical Left wing Marxist-Progressives in our Executive Branch administration whose goal is to embrace the Grea

Politics | Politics

California Lawmakers Want Wealth Tax That Will Follow Taxpayers When They Inevitably Move to Cheaper States

As people leave the State of California in record numbers, Progressive lawmakers in that state are moving ahead with plans

Politics | Politics

Fact Check: Yes, Biden's Plan Would 'Increase Taxes on Average for All Income Groups'

Taxes Up, Growth and Jobs Down.

Pets & Animals | Pets & Animals

Trump Wants to Make America a 'Manufacturing Superpower' Without Reliance on China

President Donald Trump said that if he is reelected, his administration will attempt to reduce U.S. dependence on ...

Politics | Leftists Are Insane

Why California’s Latest ‘Soak the Rich’ Tax Proposals Are Likely to Backfire

The wealthy are in many cases the most mobile members of society, and the less appealing you make your state for them financially, the more likely they are to take their success elsewhere.

Politics | Politics

California 13.3% Tax Rate May Be Raised To 16.8%...Retroactively

California’s tax rate could jump from 13.3% to a whopping 16.8%. If it passes, it could cause some Californians to hop in their Teslas and head for Texas, Nevada, Washington, or somewhere else. Anywhere would mean lower taxes.

News | News

NYC Councilman Suggests Trump Should Void Benefits to Alleged Looters

A New York City Councilman suggested that President Trump should revoke benefits given out to suspected looters arrested during the riots.

Business & Finance | Money & Finance

The IRS Is Coming for Your Payroll Protection Loan | Inc.

A recent IRS ruling says those who use the forgivable portion of a PPP loan to pay employees miss out on long-held tax breaks.

Miscellaneous | Interesting Links

Liquor Taxes Could Go Up 400%, Thanks to Congressional Dysfunction - The New York Times

A temporary cut in federal taxes on alcohol fueled the growth of American distilleries, but its expiration threatens their demise.

News | News

7 Changes to Social Security in 2020 | The Motley Fool

From what beneficiaries will be paid to what workers could owe in payroll tax, big changes are on the way for America's top social program.

Politics | Conservatism

Liberals Were Very Wrong About Tax Cuts. Again.

Once again, tax relief has spurred economic growth, stimulated higher productivity, and created jobs. The experts were wrong.

Business & Finance | Economics

Taxes Down 25 Percent Nationwide Due to Trump’s Cuts

Taxes are down 25 percent due to President Trump's tax cuts

Politics | Trump Politics

Taxes Down 25 Percent Nationwide Due to Trump's Cuts

Taxes are down 25 percent due to President Trump's tax cuts

Politics | Politics

Trump Gave Most Americans a Tax Cut and They Didn’t Notice

Republicans passed a sweeping tax cut for two-thirds of Americans in 2017, saying it would pay for itself and the American public would thank them.

Politics | Politics

Sacramento wants to tax soda, tires, guns, water, pain pills, lawyers, car batteries... - Los Angeles Times

Between state Democrats who tax like it's going out of style and the Republican federal tax overhaul, California taxpayers find themselves at the mercy of the taxman.

Politics | Illegal Immigration

Rep. Alexandria Ocasio-Cortez clarifies that illegal aliens pay TONS in taxes (and don’t get refunds) – twitchy.com

Alexandria Ocasio-Cortez notes that illegals pay TONS in taxes and don't even use government services.

Business & Finance | Business & Finance

Need Money to Pay Taxes? - Luxury Asset Buyer & Collateral Lender | Vasco Assets

Tax season has arrived. If you don’t have ready funds, there are many ways in which you could get the money to pay your taxes . Below we will guide you through a few different options that could be your saving grace when it comes time to pay the tax man

News | News

Noncitizens Use Nearly Twice the Welfare of Native-Born Americans: Study

Noncitizens, including legal and illegal, use nearly twice as much welfare as native-born Americans, according to a study. ...

Politics | The Hall of Idiots

Ocasio-Cortez: Be 'Excited' About 'Being Automated Out Of Work,' Tax Corporations At 90%

Socialist Rep. Alexandria Ocasio-Cortez (D-NY) said on Saturday that people should be "excited" about "being automated out of work" and suggested that she supports taxing corporations at 90%.

Politics | Leftist Lies

Average tax refund jumps to $3,100, dents Democrat claims of tax cut trickery

The average tax refund so far this filing season is more than $3,100, the Treasury Department reported Thursday, putting things on track and denting Democrats’ claims that the 2017 tax cuts were actually hurting Americans’ wallets.

Business & Finance | Economics

Trump tax cuts and the middle class: Here are the facts | Fox Business

While the rhetoric of the left has sought to portray the Republican tax cuts as a negative for the middle class, nothing could be further from the truth.

Politics | Leftist Lies

Sigh: I Guess We Have to Debunk Kamala Harris' Ignorant Lie That Lower Tax Refunds Equal Higher Taxes

Update: 'Four Pinocchios' from WaPo

News | News

Cuomo in Panic After Tax Revenue Comes Up $2.3 Bil Short... 'God Forbid if the Rich Leave'

In what may be seen as a shocking admission, Cuomo said that the wealthy are carrying the lion's share of the income tax burden in the state.

Business & Finance | Economics

New federal income tax form: 5 things to do before you file

Anxiety will run high this tax season. But doing your taxes still requires steps like finding the 2017 return and understanding key changes.

News | News

Majority of Non-Citizen Households in US Access Welfare Programs, Report Finds

Almost 2 out of 3 non-citizen households in the United States receive some form of welfare, according to ...

News | The News

Tax-cut repeal could cost Americans $25K in pay over 10 years, study says

According to Americans for Tax Reform, 90 percent of workers in America are receiving more take-home pay due to the Tax Cuts and Jobs Act.

Business & Finance | Economics

Kimberley Strassel:Trump could deliver a second tax cut -- without having to deal with Congress. Here's how | Fox News

What if President Trump had the authority—on his own—to enact a second powerful tax reform?

News | The News

The new 1040: A look at the proposed draft | Fox Business

The form is less than one page, but may require additional documents.

Politics | Politics

California bans local soda taxes

California Gov. Jerry Brown signed legislation Thursday that prevents local governments from taxing soda until 2031.

News | Interesting Links

New 1040 tax form will be the size of a postcard | Fox Business

U.S. Treasury Secretary Steven Mnuchin said the Internal Revenue Service will be ready to unveil new tax forms next week.

Politics | Politics

Seattle's Unloosed Monsters Will Kill The Progressive Dream

Seattle is ground zero for progressive experiments... (Its) recent contributions to the liberal virosphere include... a $275 head tax per employee to raise $48 million annually to address a rising homeless population of almost 12,000 people in a city of 7

News | News

After Trump tax cuts, most households give thumbs-up to US economy

A University of Michigan survey marks the first time since 2009 that most thought the government is doing a “good job.”

Politics | Politics

Poor Fiscal Policy Mortgaged State's Future - Hartford Courant

Op-ed: Connecticut's economy is at a crossroads because of poor fiscal discipline and pension liabilities that threaten the future prospects for out children, says Don Klepper-Smith.

Politics | Politics

Colorado: Marijuana money isn't the pot of gold voters hoped for

School district officials are often asked why they need more funding since taxes on marijuana go toward education.

Politics | Politics

GOP Tax Cuts: Rich Are Paying A Larger Share Of Income Taxes

The most frequently repeated complaint about the Republican tax cuts is that they are a massive "giveaway" to the rich. New evidence shows that this claim, like almost every other attack on the tax bill, is false.

Politics | Politics

Social Security Can Be Saved Without Raising Taxes - Bloomberg

Just keep benefits for higher earners in check.

Business & Finance | Economics

State Taxes: Americans Are Migrating In Droves To Low-Tax States

There has been a vast, largely unheralded migration in the U.S. over the past decade. Not because of weather, or amenities. But because of taxes.

Politics | Politics

Trump tax cut will increase tax for 1 million Californians | The Sacramento Bee

The Tax Cuts and Jobs Act, carried by Republicans and President Donald Trump, probably will increases taxes for at least 1 million Californians because of a cap on state and local tax deductions.

Business & Finance | Economics

Trump Tax Cuts Are Boosting Growth And Mostly Paying For Themselves, CBO Report Says

When the Congressional Budget Office released its updated budget forecast, everyone focused on the deficit number. But buried in the report was the CBO's admission that it vastly overestimated the cost of the Trump tax cuts, because it didn't account for

Politics | Politics

Top 20% of Americans Will Pay 87% of Income Tax - WSJ

One of the least discussed parts of America’s income tax is how progressive it is, and the tax overhaul didn’t change that fact. In 2018, top earners will pay a higher share of income taxes.

Politics | Politics

Here's exactly how much paychecks changed after tax reform for people at every income level from $20,000 to $269,000 a year

Trump's new tax law gave most Americans' paychecks a boost. Here's how much you're taking home every other week.

Politics | Politics

April 2019 Tax Bills May Catch Some Americans Off Guard - Bloomberg

Most Americans will owe less in taxes as a result of President Donald Trump’s overhaul of the U.S. tax code, but in a few jurisdictions, about one in 10 will be paying more, according to an analysis released Wednesday by the Tax Policy Center.

Miscellaneous | Interesting

Californians Doing The Once-Unthinkable: Leaving California | Investor's Business Daily

California has big problems, including soaring taxes, stratospheric home prices and too many regulations. But its most serious problem may be that people are leaving the state in droves.

Politics | Trump Politics

Trump Letter Surfaces, Believed to Prove Trump Sneaked Wall Funding into Spending Bill

Democrats in Congress gloated when they thought the spending bill denied Trump funds for the border wall, but some theorize that Trump will have the last laugh.

Politics | Politics

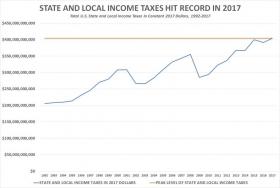

State and Local Income, Sales and Property Taxes All Hit Records in 2017

(Screen Capture)(CNSNews.com) - Real state and local income, sales and property taxes all hit records in 2017, according to data released this week by the Census Bureau.

News | The News

Fed Beige Book: Tax overhaul is boosting US wages | Fox Business

Businesses saw “modest increases in compensation” after passage of the $1.5 trillion package, according to the central bank.

News | The News

Democrats are now trying to help the 1%: Varney | Fox Business

FBN's Stuart Varney on the exodus of wealthy people from high-tax states.

Business & Finance | Money & Personal Finance

5 pieces of terrible tax advice you should ignore - Business Insider

Some advice about what to do with taxes is well-intentioned — but shouldn't be heeded.

Politics | Trump Politics

WINNING: New Poll Says Majority Of Americans Support GOP Tax Reform

A majority of Americans now support Republican-led tax reform, according to a new poll from The New York Times. The poll, done in conjunction with Survey Monkey, says that 51 percent of Americans appr

Politics | Politics

California is collecting so much of your money it can’t save it all

Democrats and Republicans want to fill California’s budget rainy day fund. But what comes next?

Politics | Politics

Home Depot employees to get up to $1,000 bonus due to tax reform

Home Depot is awarding its hourly employees in the U.S. a one-time cash bonus of as much as $1,000 following the passage of new tax legislation.

Politics | Politics

Starbucks to boost worker pay and benefits after US lowers corporate taxes

Starbucks will give domestic employees pay raises, company stock, and expanded benefits worth of more than $250 million, the company said on Wednesday.

News | The News

Jake Tapper Gets Bernie Sanders To Admit The Middle-Class Tax Cuts In The GOP Bill Are ‘A Good Thing’

On Sunday, CNN’s “State of the Union" host Jake Tapper put Sen. Bernie Sanders (I-VT) in an uncomfortable position, forcing him to acknowledge that the middle-class tax cuts in the GOP bill are a good thing:

Business & Finance | Business

In Silicon Valley, much-feared tax bill pays dividends for workers | VentureBeat

(Reuters) — The U.S. tax overhaul is a boon to Silicon Valley technology companies like Apple Inc and Alphabet Inc, which will enjoy big tax cuts and the chance to bring back billions of dollars from overseas at a reduced rate.

News | News

Victor Davis Hanson: Is California Cracking Up? | Stock News & Stock Market Analysis - IBD

Corporate profits at California-based transnational corporations such as Apple, Facebook and Google are hitting record highs. California housing prices from

Politics | POLITICS

Where the Candidates Stand on Your Taxes | MONEY

How much of your paycheck will you keep? Ahead of the election, see what Clinton and Trump are planning for your taxes.

Politics | Politics

Bombshell report on Trump taxes sends GOP nominee reeling

It puts an exclamation point on what was already one of the worst weeks for any presidential candidate in recent memory.

Business & Finance | Business

How Apple—and the Rest of Silicon Valley—Avoids the Tax Man | WIRED

Apple is not the only high-tech US firm taking advantage of tax loopholes in places like Ireland and the Cayman Islands.

Miscellaneous | Interesting Links

Sorry, Maya Dirado: You'll still have to pay taxes on that Olympic medal

Update on 'Essential Politics: Hundreds of bills live or die in Sacramento 'suspense file' action'

Politics | Politics

Bernie Sanders and his wife made $205K, according to 2014 tax returns

Sen. Bernie Sanders and his wife on Friday released their full 2014 tax return, showing a combined income of more than $205,000, following pressure from Democratic presidential campaign rival Hillary Clinton.

Science & Technology | Technology

This guy recreated that $47,000 TSA app in 10 minutes

What did this app do? Basically, it randomly selected which lane (left or right) passengers should go into in a security line.

Politics | POLITICS

45 percent of Americans pay no federal income tax

Many Americans don’t have to worry about giving Uncle Sam part of their hard-earned cash for their income taxes this year. An estimated 45.3 percent of American households — roughly 77.5 million — …

Politics | The circus we run our country with

For Cam Newton, Adding Super Tax Insult to Super Bowl Injury

He'll be paying about $101,000 of extra tax simply because the game took place in California.

Miscellaneous | Interesting stuff

Married? Pay Attention to These 4 Things at Tax Time

If this is your first tax season as husband and wife, here are four things that will be different this time around.

Politics | Politics

Caltrans seeks 5,000 volunteer motorists for mileage fee pilot program

The California Department of Transportation is seeking 5,000 volunteers for an experimental program that will charge motorists a fee based on how far they drive -- a proposal that could replace the state gas tax as a way to fund highway maintenance and re

Business & Finance | Business & Finance

Top 5 End-of-Year Tax Strategies for Small Businesses

The time to think about tax season isn't at the first of the year -- it's all year long. These five strategies can help.

Politics | POLITICS

Do the Rich Pay Their Fair Share?

Do the rich pay their fair share of taxes? It's not a simple question. First of all, what do you mean by rich? And how much is fair? What are the rich, whoev...

News | That's News to Me

This Unwelcome Aspect of Obamacare Is Going to Surprise a Lot of People in 2016 -- The Motley Fool

If you thought millions of consumers were shocked when they filed their taxes last April, then you haven't seen anything yet!

News | That's News to Me

IRS says thieves stole tax info from additional 220,000 - Yahoo Finance

From Yahoo Finance: A computer breach at the IRS in which thieves stole tax information from thousands of taxpayers is much bigger than the agency originally disclosed. An additional 220,000 potential victims had information ...

News | The News

Chicago finds new tax stream: Netflix, Spotify, online gambling - Jul. 2, 2015

Chicago has expanded its taxing power to extend to streaming services. The city's residents will now pay an extra 9% tax to use services such as Netflix and Spotify.

Politics | The IRS

Report: IRS Deliberately Cut Its Own Customer Service Budget | The Weekly Standard

If you tried to contact the IRS with a question about your taxes this year, chances are you didn't get a response. The IRS estimated that it would only answer 17 million of the 49 million calls received this filing season. Taxpayers lucky enough to have the IRS answer their calls waited an average of 34.4 minutes for assistance--nearly double the wait time last year (18.7 minutes).

Miscellaneous | Interesting Links

What Does the IRS Do With All the Paperclips People Send Them? | Mental Floss

The IRS becomes the proud owner of a huge batch of new paperclips each year. So, what do they do with the influx of office supplies?

Business & Finance | FINANCE & INVESTMENTS

6 Red Flags That Can Get You Audited

There’s nothing quite as heart-stopping as a notice from the IRS. Sometimes it’s to raise a question about an item on your return; other times you may get a notice that you owe money. If you’re really unlucky, you may find out the IRS is auditing your return.

News | The News

Californians Now Paying A ‘Global Warming’ Fee On Gasoline | Truth And Action

A $.10 fee is now being added to each gallon of gas, before sales tax, in California. It is a tax, but that isn't what they are calling it. Instead, the fee is described as an amount paid by gas retailers when distributors load tanker trucks. So Califor

Politics | Interesting Links

Do the Rich Pay Their Fair Share? - Prager University

Do the rich pay their fair share of taxes? It's not a simple question. First of all, what do you mean by rich? And how much is fair? What are the rich, whoever they are, paying now? Is there any tax rate that would be unfair? UCLA Professor of Economics,

Politics | Politics

First Time Ever: Federal Tax Revenues Top $1 Trillion Thru January; Gov't Still Runs $194B Deficit | CNS News

Inflation-adjusted federal tax revenues hit a record $1,046,224,000,000 for fiscal year 2015 through January, but the federal government still ran a $194,209,000,000 deficit during that time, according to the latest Monthly Treasury Statement.

Business & Finance | Business & Finance

10 Crazy Sounding Tax Deductions IRS Says Are Legit - Forbes

Tax returns are signed under penalties of perjury, so you can't lie. But creativity sometimes pays off. Do you feel lucky today?

History | History

What 11 Common Objects Would Cost in 2015 if Colonial Taxation Still Existed | Mental Floss

It’s safe to say the American colonists were pretty upset about the taxes and tariffs imposed on imported goods in the 1760s and 1770s—upset enough to start a war. But at rates like ten shillings or a couple of pounds, the tariffs hardly sound oppressive to modern ears. That is, until you do the math...

Business & Finance | Business & Finance

Why marketing is a great year-end tax write-off | VentureBeat

GuestLiterally every dollar invested in marketing can be effectively written off.

Politics | Interesting Links

The Progressive Income Tax: A Tale of Three Brothers - Prager University

The Progressive Income Tax is one of those economic terms that gets bandied about, but few actually know what it means or how it works. This tale of three similar brothers with three different incomes (but one shared expense) helps explain the tax system

Politics | Politics

Here's How Gasoline Taxes Stack Up State By State

Gas taxes range from 12 cents to over 50 cents per gallon on the state level. What are you paying?

Politics | Politics

BILL CLINTON: Executives Think The US Tax Code Is 'Crazy' - Yahoo Finance

Bill Clinton is calling on the US to follow other countries around the world and lower its corporate tax rate to reduce so-called corporate "inversions" — the controversial practice of relocating a company headquarters overseas to take advantage of lower rates. When executives now look at other countries' tax codes, they think the US system is "crazy," Clinton said.

News | The News

$2.66T: Tax Revenues for FY14 Hit Record Through August; Gov’t Still Runs $589B Deficit | CNS News

Inflation-adjusted federal tax revenues hit a record $2,663,426,000,000 for the first 11 months of the fiscal year this August, but the federal government still ran a $589,185,000,000 deficit during that time, according to the latest Monthly Treasury Stat

Politics | Interesting Links

Thousands of Americans surrendering their passports due to huge hike in government fees

Large tax bills faced by Americans who have not lived in their country for years are forcing US citizens to renounce their nationality - but only at a cost

Politics | Op-Ed

Government will take every penny you've earned so far this year: Examiner Editorial

As Americans celebrated this nation's birthday on July 4, most were likely unaware of a less uplifting commemoration that fell on the calendar during the same holiday weekend. That was Cost of Government Day, or July 6, 2014. The date's significance is on

News | The News

Federal Tax Revenues Set Record Through May; Feds Still Running $436B Deficit

Federal tax revenues continue to run at a record pace (in inflation-adjusted dollars) in fiscal 2014, as the federal government’s total receipts for the fiscal year closed May at an unprecedented $1,9

Politics | Interesting Links

13 Maps That Show If You Live in a Democrat-Run State, Chances are You Want to Move

Let's get real, just for a moment.

Politics | Politics

Taxing Drivers By The Mile An Obvious Revenue Grab

California drivers pay for the roads, highways and bridges they use when they buy fuel and they already pay the highest fuel taxes in the country.

Politics | Woke Insanity

Sen. Introduces Bill To Test Out Taxing Motorists For Every Mile They Drive - CBS Los Angeles

The California Legislature is looking at a voluntary program that would tax motorists for every mile they drive.